The 2022 Federal budget included a few changes to the way some real estate transactions are taxed. The two mains changes are the new residential property flipping rule and changes to the way GST/HST on assignments is taxed for individual. In this post I will be discussing the latter.

Summary of the changes to GST/HST on assignments effective May 7th 2022:

- The new change makes it so that there is GST/HST on assignments regardless of original intentions. Previously, if the original intention of entering the pre-construction contract/Agreement of Purchase and Sale (APS) was for personal use, GST/HST on assignments did not apply. But if the intention was to sell for profit or flip the property, GST/HST applied.

- The legislation officially recognizes that GST/HST is not payable on the portion of the consideration exchanged that represents the deposit that the assignor paid to the seller/builder.

I have seen people talk about these changes as if it will slow down the housing market because they seem to incorrectly assume that GST/HST on assignments is double levied or increased. The changes actually add certainty to the way GST/HST on assignments are taxed.

Let’s do an example of pre- and post- May 7th 2022 changes. Here is the assignment details (closely maps on to OREA Form 145/150 Schedule B):

- Purchase Price on the original APS = $1,000,000

- Payment by Assignee to Assignor for this Assignment Agreement = $100,000*

- Total Purchase Price including the Original APS and this Assignment Agreement: $1,100,000

- Deposit paid by the Assignor to the seller under the original APS to be paid by the Assignee to the Assignor: $200,000

**For the sake of simplicity, this excludes GST/HST but in practice, most assignment agreements will stipulate that GST/HST is included

Under the pre-May 7th 2022 rules according to the CRA*, GST/HST would have been payable on the whole amount that the assignee pays to the assignor, $300,000, which results in HST payable of $39,000 in Ontario (13%*300,000).

*Note that it was the CRA’s view that GST/HST is levied on the deposit. In reality this was challenged successfully in a 2013 Tax Court case and a taxpayer can file their GST/HST return without including the amount attributable to the deposit. But the CRA continued to levy GST/HST on the deposit amount in audits and reassessments so taxpayers unaware of the Tax Court ruling would end up paying additional GST/HST.

Under the post-May 7th 2022 rules, GST/HST on assignments is officially only payable on the payment by the assignee to the assignor, $100,000, which results in HST payable of $13,000 in Ontario. This will force the CRA to update their practice guidelines and hopefully they will no longer expect GST/HST on deposits in audits and reassessments.

The Nitty-Gritty

Lately, I have seen a lot of incorrect information shared by investors, agents, accountants, and lawyers regarding the new GST/HST changes so I hope that this post can put to rest any uncertainty on this issue by giving concrete examples and referring to the budget documents (the link goes to the Supplementary Information attached to the Federal Budget).

Many people are confused about the new changes to GST/HST on assignments and I think it largely stems from the imprecise use of language when talking about assignment agreements.

Before we begin, let’s start with some general definitions I will use in this post and are relevant in assignments:

- APS = Agreement of Purchase of Sale = Pre-Construction Contract

- Buyer = Assignor. The buyer is the individual who signed APS to buy the property. They will also be the assignor in the assignment agreement by assigning the APS to the assignee.

- Seller = Builder. The seller is the builder who signed the APS to sell the property. Note that most pre-construction agreements have a clause that give the seller some rights in an assignment of the contract (ie. seek seller permission and/or an assignment fee).

- Assignee = first occupant. The assignee is the person who will be assigned the APS and wants to eventually close on the property and live in it therefore, in most cases, they will be the first occupant.

- Taxable Supply – means a supply that is made in the course of a commercial activity (from the Excise Tax Act (the “ETA“) S123(1))

- Budget Day – April 7th 2022.

There are two main paragraphs most relevant to the new changes and I will explain what both of them mean. The first:

Budget 2022 proposes to amend the Excise Tax Act to make all assignment sales in respect of newly constructed or substantially renovated residential housing taxable for GST/HST purposes. As a result, the GST/HST would apply to the total amount paid for a new home by its first occupant and there would be greater certainty regarding the GST/HST treatment of assignment sales.

Supplementary Information for the 2022 Federal Budget (https://budget.gc.ca/2022/report-rapport/tm-mf-en.html#a5_2)

I believe some people have misinterpreted this paragraph, specifically the underlined section. The total amount paid by the first occupant is the purchase price on the APS (net of GST/HST as it is usually included in the price) plus the amount the first occupant/assignee paid for the assignment contract (also net of GST/HST).

The legislators have reframed the GST/HST on assignment sales from a taxable supply provided by the assignor, to the GST/HST owed because that is the “true purchase price” that the first occupant paid for the property. There is no double taxation. The amount of GST/HST on assignments is just being levied on the original APS price plus the additional amount the assignee paid to the assignor.

Which leads to the next paragraph:

Typically, the consideration for an assignment sale includes an amount attributable to a deposit that had previously been paid to the builder by the assignor. Since the deposit would already be subject to GST/HST when applied by the builder to the purchase price on closing, Budget 2022 proposes that the amount attributable to the deposit be excluded from the consideration for a taxable assignment sale.

Supplementary Information for the 2022 Federal Budget (https://budget.gc.ca/2022/report-rapport/tm-mf-en.html#a5_2)

The GST/HST on the deposit never made sense because the assignee was essentially returning the deposit that the assignor already paid to the builder which was already subject to GST/HST in the APS. This new reframing of the assignment sale solves that quirk because the deposit is already accounted for in the assignee’s “true purchase price”.

The Nittier-Grittier

So this is where going to law school comes in handy. If the above has not convinced you, please read on but otherwise, this might be a bit dense as I convert each part of the change to the ETA in everyday language that even a non-tax lawyer can understand (hopefully).

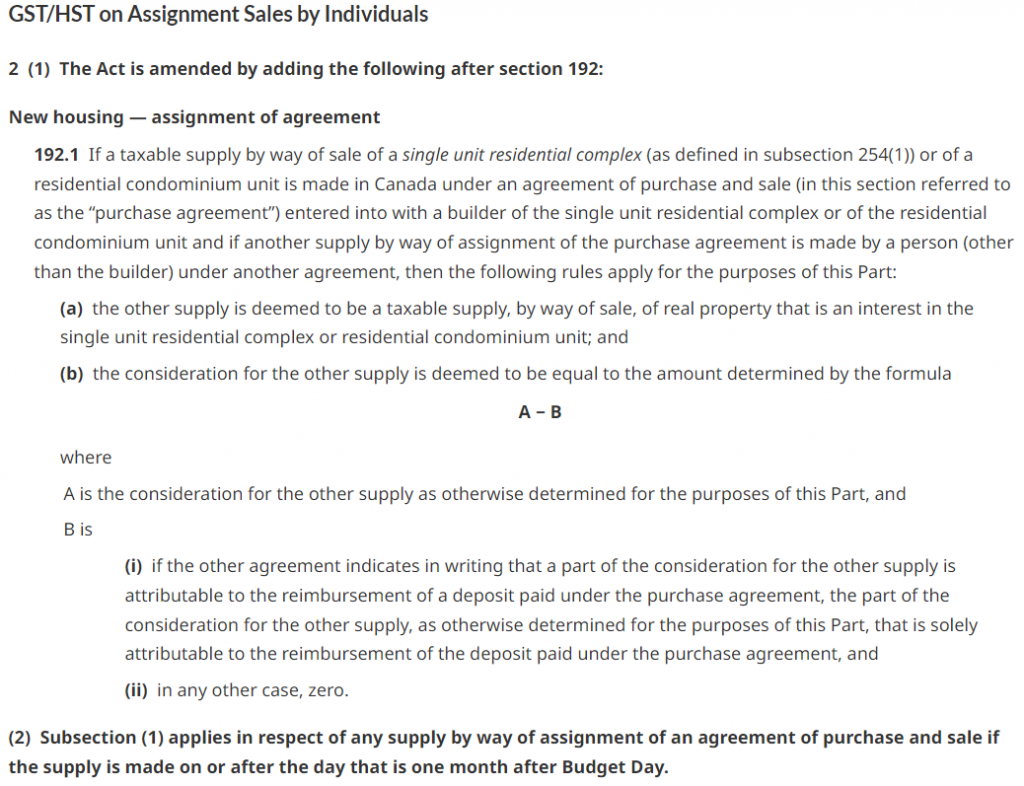

If a taxable supply by way of sale of a single unit residential complex (as defined in subsection 254(1)) or of a residential condominium unit is made in Canada under an agreement of purchase and sale (in this section referred to as the “purchase agreement”) entered into with a builder of the single unit residential complex or of the residential condominium unit […]

Translation/simplification: If a taxable supply by way of an APS is entered into …

[…]and if another supply by way of assignment of the purchase agreement is made by a person (other than the builder) under another agreement, then the following rules apply for the purposes of this Part:

Translation/simplification: …and if there is another supply (profit from the assignment) by way of the assignment of the APS, then the following rules apply:

(a) the other supply is deemed to be a taxable supply, by way of sale, of real property that is an interest in the single unit residential complex or residential condominium unit; and

They key phrase here is “other supply” because it does not refer to the original taxable supply which would have been the entire purchase price of the property in the APS. Instead, the “other supply” refers to the profit the assignor made in assigning the APS to the assignee.

Translation/simplification: (a) the profit from the assignment agreement is deemed to be a taxable supply.

(b) the consideration for the other supply is deemed to be equal to the amount determined by the formula A-B where

Translation/simplification: (b) the profit from the assignment agreement is determined by the following formula A-B where

A is the consideration for the other supply as otherwise determined for the purposes of this Part, and

Translation/simplification: A is the total amount the assignor received before HST, and

B is

(i) if the other agreement indicates in writing that a part of the consideration for the other supply is attributable to the reimbursement of a deposit paid under the purchase agreement, the part of the consideration for the other supply, as otherwise determined for the purposes of this Part, that is solely attributable to the reimbursement of the deposit paid under the purchase agreement, and

(ii) in any other case, zero.

Translation/simplification: B is a reimbursement from the assignee to the assignor for the deposit paid in the APS if applicable

And putting it all together:

If a taxable supply by way of an APS is entered into and if there is another supply (profit from the assignment) by way of the assignment of the APS, then the following rules apply

(a) the profit from the assignment agreement is deemed to be a taxable supply.

(b) the profit from the assignment agreement is determined by the following formula A-B where

- A is the total amount the assignor received before HST, and

- B is a reimbursement from the assignee to the assignor for the deposit paid in the preconstruction agreement if applicable

Conclusion

This new change introduces more certainty and logic into the tax code which is good for society overall.

Realistically, this only disadvantages those who have a change in circumstance and are “forced” to assign their property before closing. For example, this could be due to interest rate hikes that prevent a taxpayer from obtaining a mortgage or getting a new job elsewhere and no longer needing the property.

But it does create a positive incentive for real estate flippers to follow the law as it closes off one of the avenues for avoiding GST/HST on assignments (though income tax is a whole other issue). I don’t think it will have any meaningful effect on house prices, unless people believe in the incorrect information.

4 replies on “2022 Changes to GST/HST on Assignments”

First, I love the article.

I called CRA. The gentlemen there said he is not aware of any changes from May 7th and says HST is still chargeable on the deposit. This makes no sense that the deposit should have ever been considered to be taxed.

Thank you! Yes, the CRA phone reps aren’t really held accountable for the information they give out so if there is ever any conflicting information I would triple check it. As I mention in the post as well, the CRA continued to audit and reassess HST on the whole deposit. I guess the CRA auditors rely on their practice guidance which, as far as I can tell, is from 2011 and wasn’t updated even after the 2013 case against their interpretation. Hopefully they will be issued new practice guidance soon but it might take awhile for it to trickle down to the CRA phone reps.

Awesome article Ed. 👏

Thanks, glad it was helpful!